The global Intelligent Pigging Market Size reached a value of USD 744.55 million, and it is expected to grow at a compound annual growth rate (CAGR) of 5.4% during the forecast period of 2024-2032. By 2027, the market is anticipated to reach a value of approximately USD 1,008.90 million. This article delves into the key benefits, market drivers, trends, challenges, and the overall outlook for the intelligent pigging market.

Key Benefits of Intelligent Pigging

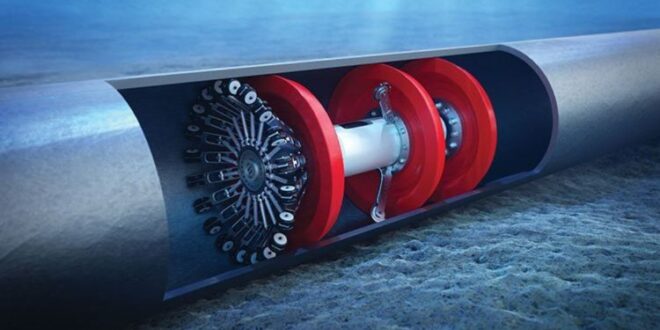

The use of intelligent pigging technology offers several benefits that make it indispensable for industries relying on pipeline systems:

- Enhanced Pipeline Safety: Intelligent pigs can detect critical flaws like corrosion, cracks, and other defects that are invisible to the naked eye. Early detection helps avoid catastrophic failures and prevents environmental damage.

- Regulatory Compliance: Many governments require pipeline operators to regularly inspect and assess their pipelines. Intelligent pigging helps companies meet regulatory standards and ensures compliance with health, safety, and environmental laws.

- Cost Savings: Detecting and addressing potential issues before they escalate helps reduce repair costs, prevent pipeline failures, and minimize downtime.

- Increased Pipeline Lifespan: By regularly monitoring pipeline integrity, intelligent pigging contributes to longer pipeline life, thus improving operational efficiency.

- Accurate Data Collection: Equipped with high-tech sensors, intelligent pigs gather precise information about the condition of pipelines. This data can be analyzed to inform maintenance strategies, reducing the risk of unexpected issues.

Key Industry Developments

Several key developments have shaped the intelligent pigging industry over recent years:

- Technological Advancements: There has been a significant improvement in sensor technologies, software analytics, and data interpretation systems. This has led to the development of more accurate and efficient intelligent pigging solutions.

- Mergers and Acquisitions: Major players in the industry have engaged in strategic partnerships and acquisitions to expand their capabilities. For example, General Electric (GE) divested its oil and gas division, which was later merged with Baker Hughes, significantly boosting their intelligent pigging operations.

- Automation and Digitalization: The move towards fully automated and digitized pigging operations has revolutionized the way inspections are conducted, making the process faster and more reliable.

- Increased Focus on Environmental Protection: With the rising awareness of environmental sustainability, companies are investing more in intelligent pigging to prevent pipeline leaks that can lead to environmental disasters.

Driving Factors

Several factors are propelling the growth of the intelligent pigging market:

- Increasing Energy Demand: The growing global energy demand, particularly in developing regions, is pushing pipeline operators to ensure that their infrastructure is well-maintained and functioning efficiently. This, in turn, drives the need for intelligent pigging services.

- Stringent Regulatory Norms: Governments worldwide have imposed stringent safety regulations on pipeline operators, requiring regular inspections to prevent accidents and leaks. This mandates the use of intelligent pigging solutions.

- Aging Infrastructure: Many pipelines, especially in North America and Europe, are aging and require continuous monitoring to prevent failures. This has created a booming demand for intelligent pigging to assess and maintain these pipelines.

- Focus on Operational Efficiency: Companies in the oil and gas sector are increasingly focusing on optimizing their operations and reducing operational costs, which has led to a greater adoption of intelligent pigging.

Impact of COVID-19

The COVID-19 pandemic had a considerable impact on the intelligent pigging market. Due to lockdowns and travel restrictions, many pipeline inspection and maintenance activities were delayed or canceled. However, the pandemic also highlighted the importance of maintaining critical infrastructure, pushing companies to adopt intelligent pigging technology to ensure pipeline integrity remotely, where possible.

Additionally, the pandemic accelerated the digital transformation of industries, which in turn has supported the growth of intelligent pigging solutions that offer remote monitoring and data analysis.

Restraining Factors

While the intelligent pigging market is on a growth trajectory, it faces certain challenges:

- High Initial Investment: The cost of purchasing and implementing intelligent pigging solutions can be high, especially for smaller pipeline operators. This can be a significant barrier to market growth.

- Operational Complexities: The technology and processes involved in intelligent pigging require skilled personnel for proper execution and data interpretation. This increases the overall operational complexity for companies.

- Environmental Challenges: Pipelines that traverse challenging terrain or undersea environments can present logistical difficulties for intelligent pigging operations, sometimes limiting its use.

Market Segmentation

The intelligent pigging market can be segmented based on:

-

By Technology:

- Magnetic Flux Leakage (MFL)

- Ultrasonic Testing (UT)

- Others

-

By Application:

- Metal Loss/Corrosion Detection

- Crack and Leak Detection

- Geometry Measurement & Bend Detection

-

By Pipeline Type:

- Gas

- Oil

- Chemicals

Market Outlook

The intelligent pigging market is expected to continue its upward trend, driven by increasing global energy demands, stringent safety regulations, and advancements in pigging technologies. With the ongoing push for digitalization, automation, and the rise of IoT (Internet of Things) in pipeline monitoring, the industry will likely see further innovations that will make inspections more efficient and cost-effective.

Regional Analysis/Insights

The intelligent pigging market is segmented into several key regions:

- North America: The largest market for intelligent pigging, driven by extensive pipeline infrastructure and strict regulatory requirements.

- Europe: A mature market with aging infrastructure and a strong focus on environmental sustainability, contributing to growing demand for intelligent pigging.

- Asia-Pacific: Expected to witness significant growth due to the increasing energy demand, particularly in China and India, where new pipeline projects are being developed.

- Middle East and Africa: The region’s vast oil and gas reserves make it a key market for intelligent pigging services.

Industry Trends

Several notable trends are shaping the intelligent pigging market:

- Adoption of Robotics: Companies are integrating robotics into their intelligent pigging systems, enabling more precise and autonomous operations in challenging environments.

- Predictive Maintenance: Leveraging AI and machine learning, companies are now focusing on predictive maintenance, allowing them to detect and address issues before they lead to failures.

- Green Energy Transition: As the world moves towards renewable energy sources, there is a growing demand for hydrogen and carbon capture pipelines, requiring intelligent pigging solutions tailored for these new applications.

Major Key Players

The intelligent pigging market is highly competitive, with several major players dominating the landscape:

- T. D. Williamson, Inc.

- ROSEN Swiss AG

- Enduro Pipeline Services, Inc.

- Intertek Group plc

- Applus Services, S.A.

- LIN SCAN

- Dexon Technology PLC

- Others

These companies are heavily investing in R&D and expanding their global presence through mergers, acquisitions, and partnerships.

Opportunities

- Expansion in Emerging Markets: Emerging economies, especially in the Asia-Pacific region, present significant opportunities for the intelligent pigging market as they expand their pipeline infrastructure to meet growing energy demands.

- Technological Innovations: There are abundant opportunities for growth through the development of more advanced, automated, and AI-driven pigging technologies.

Challenges

- Skilled Workforce Shortage: The lack of skilled professionals to operate and interpret data from intelligent pigging devices remains a significant challenge for the industry.

- High Operational Costs: Despite the benefits, the high operational costs associated with intelligent pigging continue to limit its adoption, particularly among smaller players.

Personal Finance and Attractive Interest Rates Unlock Smart Savings with Low Rates and Expert Financial Tips

Personal Finance and Attractive Interest Rates Unlock Smart Savings with Low Rates and Expert Financial Tips